BLACK FRIDAY SALE NOV. 27-DEC. 1

Are you sick & tired of getting in your own way and sabotaging your chance at lasting wealth & financial success?

Pick any single training from the Wealthy Woman’s Blueprint online training system for just $97 (Value $150). Sale ends at 11:59PM ET Tuesday, December 1st!

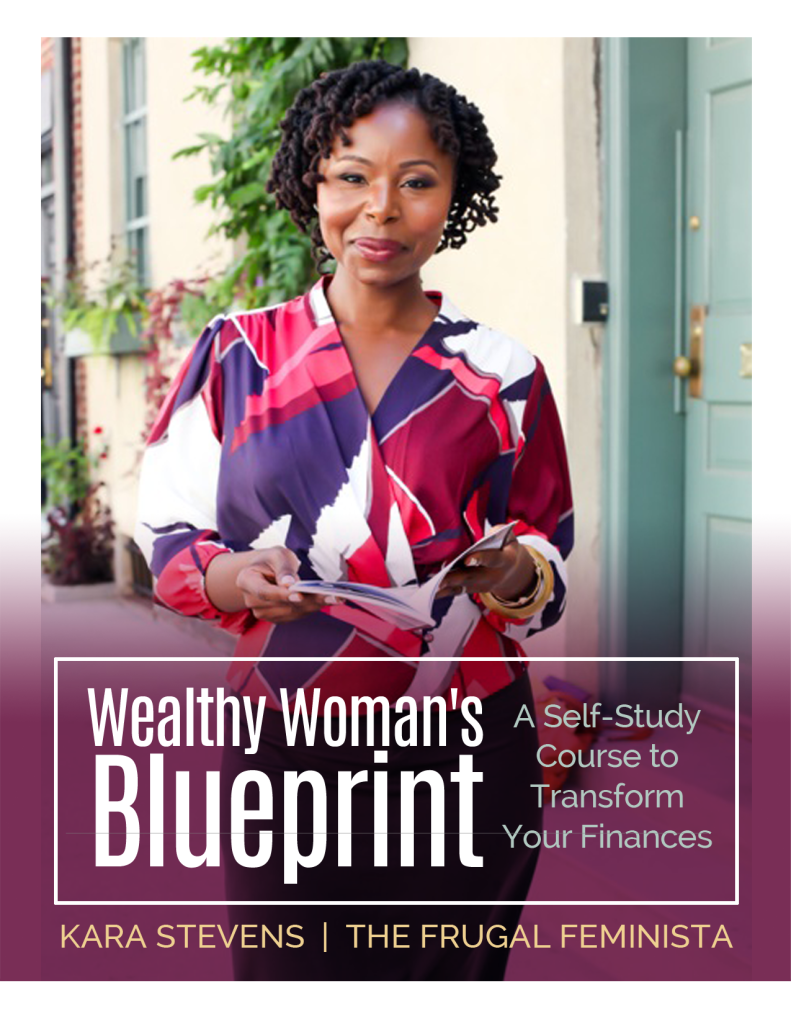

I’m Kara Stevens, Founder of The Frugal Feminista and creator of the Wealthy Woman’s Blueprint. For the past few years, I’ve been teaching women to how rid themselves of debt, break free from being broke, and embark on their journeys to financial freedom and wealth.

And what I’ve learned is that it takes not only vision and courage to follow your dreams of abundance and wealth, but it also takes a roadmap, a pathway…a blueprint so-to speak to get you there in the shortest amount of time.

More about me later, but first I have a question to ask you…

Does this scenario sound familiar?

Pay day comes but instead of being grateful for your income and doing a happy dance, you are stressed out and anxious… and quite frankly… a little angry.

You are in your feelings because you know that you can’t touch any of that money. You can’t use any of that money for the things that you want to buy or the financial future that you yearn to have.

The money is already spent before it hits your account.

On top of having to pay for rent, groceries, gas, and transportation, your check is going straight to pay down your credit card debt and your student loan payments.

That is… on a good month and if you are lucky.

Sometimes, there is more month than money and some bills cannot be paid in full.

With each check that comes, you are robbing Peter to pay Paul.

You are paying a little here and a little there but you can’t seem to get back on track to building the wealth you deserve.

You feel like you are slipping further and further into debt despite getting up every morning, fighting through traffic, and working hard every day.

Every day.

In your heart and in your spirit, you know that you are capable of wealth if you just had a way of reining in your spending, some guidance for eliminating your debt, and a support system of accountability.

You know that if you were given the tools and information to build wealth, you would take them and run with them.

But for now, instead of earmarking your income for wealth: building a plump retirement account, starting your online business, and building your 5-figure emergency fund, you spend all of your time worrying.

Fretting.

You are so frustrated and fearful about your finances that you find yourself unable to sleep.

You spent the time that you should be sleeping looking up at the ceiling wondering about when you will be able to make your financial reality match the vision that you have for your financial future.

In the pit of your stomach, you feel everything churning. You feel sick having to deal with all of your financial issues- how to quit living paycheck to paycheck, how to handle debt collectors, how to save when you don’t think there’s enough to save— alone.

And while you know that you shouldn’t, you start to compare yourself to all of your friends that seem to have it all.

Every time you turn around, they are taking vacations.

They are paying off their student loans in full.

They are paying off their car notes.

They are not just contributing to their retirement accounts—they are maxing them out.

They are moving from being home renters to home owners.

They are talking about their investment portfolios and what new business ventures they want to start.

They are able to donate money to causes that are important to them.

They seem happy AND wealthy.

And while you are happy for them because they are your friends, you can’t help but wonder:

“Why them and not me?”

“Why did they do that I didn’t do?”

You end up crying yourself to sleep making you feel even more depressed and overwhelmed about your financial problems.

Now let me get a little more personal here…

Do your dreams of wealth and abundance literally scare you?

Maybe the real reason that you’re up in the middle of the night thinking about money is because you can vividly see yourself living your best and wealthiest life if you could just get out of your own way.

Have you had the experience of writing your goals down in your journal and actually started crying because you know that if you could just get your budget right and your spending together, that it could CHANGE your entire life?

Yet even after experiences like that, you feel disappointed in yourself because you allow all of the negative chatter in your mind to keep you from striving to build a legacy of wealth for yourself and your family.

No matter how inspiring your vision is, you keep listening to that nagging voice that says you’re not good enough, you’re not build for success, and you don’t have the stamina to make it happen for yourself.

Are you being called to say yes to your abundance and wealth right now?

Maybe there’s an area in your finances that you really want to improve or make progress on – budgeting, getting out of credit card debt, aggressively attacking your student loans, starting a lucrative online business, and getting yourself ready for a comfortable retirement.

Well, what if…instead of just WISHING that things were different, you gave your dedicated focus to all of those money goals.

I’m certain you would begin to see big results and new possibilities, just like I’ve been able to do with my personal finances.

These are just some of my money milestones I’ve been able to achieve once I started to think like a wealthy woman:

- I’ve been able to eliminate over $65K worth of student loan debt and consumer debt, $40K of which I was able to do in a little over two years.

- I’ve started The Frugal Feminista as a hobby but have been able to grow it into a lucrative online business, which grosses over $12K a year while still maintaining a 9-5 that I love.

- I’ve created a passion-based budget that allows me to travel to visit friends and family in Antigua, Tobago, and England without worrying about the money.

- I’ve been featured in major media outlets including Black Enterprise, Ebony Magazine, ESSENCE.com, The Root, and The Network Journal.

- I’ve kept my credit score at 800 and more for the longest.

The good news is…you can do this, too!

The other good news is… you are in good hands.

Instead of waiting for SOMEDAY, you might be surprised at what’s truly possible for you to do RIGHT NOW.

If it’s time for you to finally start FOLLOWING THROUGH on some of your big money and abundance goals, I invite you to register for The Wealthy Woman’s Blueprint.

The days of listening to your FEAR of FINANCIAL FAILURE are over.

It’s time to start acting on your FAITH that everything is possible for you. The truth is, you are powerful and prosperous beyond measure.

And my purpose is to help you realize that.

PICK ANY SINGLE TRAINING FOR JUST $97

14-Day Money Back Guarantee

If you’re not satisfied for any reason, just let us know and we’ll refund your investment. We know that if you use this information it will change your life so we stand firm behind our products!