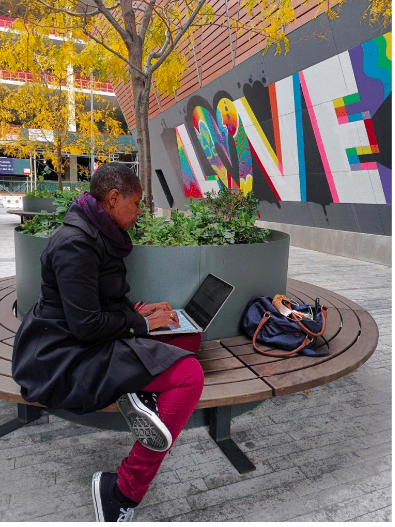

I became a teacher because of my passion for social justice. I wanted to give girls and boys that looked like me a chance to feel the love and support from someone that they could culturally relate to. I also wanted to give them the critical thinking tools to make them feel like they could be anyone that they wanted to be.

I became a teacher because of my passion for social justice. I wanted to give girls and boys that looked like me a chance to feel the love and support from someone that they could culturally relate to. I also wanted to give them the critical thinking tools to make them feel like they could be anyone that they wanted to be.

I loved what I was doing, but I ultimately knew that I wanted to affect change outside of the classroom by impacting school culture so I knew that returning to grad school had to be in my future.

I loved what I was doing, but I ultimately knew that I wanted to affect change outside of the classroom by impacting school culture so I knew that returning to grad school had to be in my future.

But I was conflicted.

I wanted to find a program for educational administration that was more than just a practical set of coursework. I wanted a program that helped me look at leadership and adult learning in a deeper, more thoughtful way. I wanted my learning to extend to behind the coursework.

And while I had this deep need for intellectual stimulation, I was concerned about how I was going to afford my graduate degree. Even though I was making a teacher’s salary, it was still a steady stream of income that I didn’t want to give up if I didn’t have to.

And this is real talk. Thinking about how I was going to pay for my degree was a major part of my decision-making process. Luckily, I found a program that I could complete during my summer vacation. This allowed me to work so I knew that I had a way to repay the $40k I had to take out in order to return to school.

Before returning to grad school, I started looking for jobs as an educational administrator so I could really leverage the new degree and feel good about my decision to invest five-figures for a new degree.

Before returning to grad school, I started looking for jobs as an educational administrator so I could really leverage the new degree and feel good about my decision to invest five-figures for a new degree.

Once I started the program, I didn’t stop thinking about the money. I was in the financial aid office allllll of the time… I was hell-bent on finding any amount of information about grants and loan forgiveness to finance my student loan. I even spoke with other senior graduate students to learn about how they were paying for the degree and managing their loans.

When I look back on the whole grad school journey, I’m glad that I went in with my eyes wide open about the process (I realize this isn’t always the case!). It made the repayment process manageable and very doable. Knowledge about the process and available options can really make a difference in determining the best path forward.

When I look back on the whole grad school journey, I’m glad that I went in with my eyes wide open about the process (I realize this isn’t always the case!). It made the repayment process manageable and very doable. Knowledge about the process and available options can really make a difference in determining the best path forward.

Companies like College Ave Student Loans help alleviate the stress of covering the costs of a postgraduate, master’s, doctoral or professional degrees by creating a graduate student loan that fits your budget and goals. They answer your questions, simplify the application process, and have so many helpful tools to help you calculate interest, how much you need, and provide flexible repayment options without an origination fee. It’s important to know all your options when applying to graduate school, and College Ave makes the process easy and user friendly.

When you’re thinking about investing in your education, the smart way requires thinking not only about your major but also about the money. Thinking this way will keep you excited about learning and about your future.

Be sure to visit College Ave Student Loans if you are interested in taking the stress out of covering the costs of a postgraduate degree!

This is a sponsored post written by me on behalf of College Ave Student Loans. All opinions are my own.

This is a sponsored post written by me on behalf of College Ave Student Loans. All opinions are my own.